People of all ages and income levels have been affected by America’s high inflation and recession fears. From college graduates just entering the workforce to seniors on a fixed income, everyone is concerned about their financial forecast for 2023. Metric Financial, a leading financial planning firm in CT, has developed a series of tips to ensure that no matter what the year brings, individuals and closely held businesses will be financially fit throughout it.

“With the current stock market volatility, the United States’ 31 trillion-dollar debt, and recent bank collapses, many people are naturally fearful about how these events will affect them this year and beyond,” said Timothy Baker, a Chartered Financial Analyst and founder of Metric Financial in Simsbury. “We have developed proven techniques designed to help protect your wealth throughout every decade of your life and manage through the ever unpredictable financial markets.”

Specifically, Metric Financial recommends the following advice for each stage of life:

Ages 25-35: Think long-term. Be as aggressive as your stomach can handle. And make a plan – understand what your cash needs are and sock away the rest. The majority of long-term investments should be in stocks and diversified with Exchange Traded Funds (ETFs). Make sure to put enough into company retirement plans to get the matching contributions. Consider the advantages of a Roth IRA if you are eligible. If you have children, strongly consider a 529 plan for college savings. If you plan to work with an advisor, scrutinize fees closely.

Ages 35-55: If you have children, continue to fund college savings plans, but also know the rules and consider alternative places to save for education. Begin to increase contributions into company retirement plans, but also think about what taxes will look like in retirement and think about tax diversification. Update your plan and change your allocation between stocks and bonds accordingly – this should not be automatic, but rather based on projected needs. In a similar vein, evaluate what is in your employer’s retirement plan. Target Date Funds are not always the best choice, but many plans default to them.

Age 75 and up: The plan still matters! At this point, the IRS is requiring you to take distributions from your retirement account. Do you need them for income? Or can you reinvest them in another account to ensure the funds continue to grow for heirs? Make sure to revisit your estate plan. Is your will up to date? Do you need a trust? Are beneficiaries properly assigned to investment accounts? It’s a great time to make sure your financial house is in order so you can relax and enjoy the fruits of your decades of labor!

“With proper planning for your age group, we can not only withstand this economic turbulence, but be protected in the future,” adds Baker.

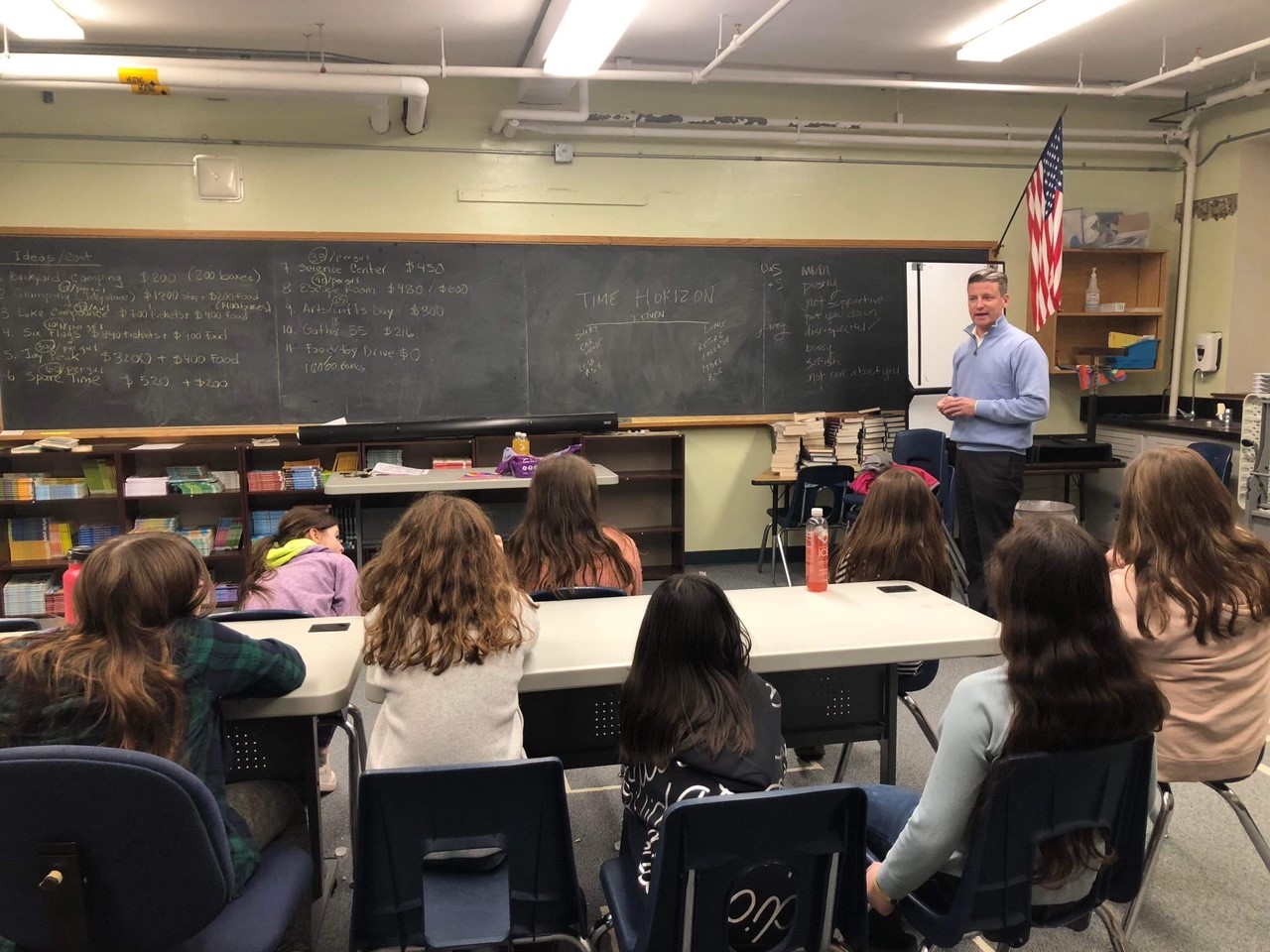

Founded in 2018, Metric Financial, LLC is registered as an Investment Adviser with the State of Connecticut. Led by Chartered Financial Analyst Timothy Baker, the firm provides investment management services, comprehensive financial planning, debt management, estate planning, retirement planning, risk management and tax planning, among others. Baker conducts frequent educational sessions and public seminars on a variety of financial topics of interest to schools, business groups, and associations. For more information, please visit www.metricfin.com or call 860.256.5895.

PHOTO: Tim Baker of Metric Financial educates the young and old alike on the proper investment strategies for their particular age bracket.

Photo Courtesy of: Metric Financial