The State of Connecticut is known as the Constitution State. One local resident lives up to this as a longstanding U.S. Constitution student. Activist and Hoodwinked author Joe Patrina explains why family home and vehicle property taxes levied by municipalities are NOT constitutional. Why? Only houses of representatives can levy taxes – not municipal budgeting. Seeking to restore “No taxation without representation”, Patrina has embarked on a campaign to bring an Original Jurisdiction case to the U.S. Supreme Court.

“I invite all citizens to step away from America’s diversionary political brawl, and instead explore a long game “property-tax-and-taking reversal strategy” that restores one’s economic liberty in owning property free and clear. Let’s protect property while we still can,” said Patrina.

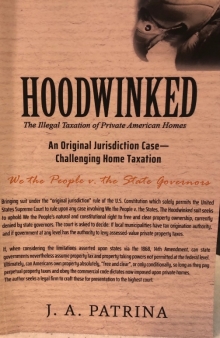

Patrina’s Hoodwinked: The Illegal Taxation of Private American Homes documents how governors use municipalities to circumvent the U.S. Constitution, effectively instructing municipalities into following uncontested state tax code over the U.S. Constitution.

Detailed topics covered in the book include:

- How the constitution intersects with municipal taxation

- Whether state governors realize that municipal practices are unconstitutional

- How unconstitutional municipal tax code has been allowed

- Why the U.S. Supreme Court hasn’t ruled on it yet

- Why the U.S. Supreme Court would likely rule on it now

- How free-K-to-12-education will be handled

- Who will pay for local roads and police

- How inalienable, natural rights relate to property

Most importantly, Patrina’s research extracted the obvious: first, that taxation without representation, enacted through municipal budget processes rather than by each state’s House of Representatives violates the Constitution’s Tax Origination Clause, and second, that Municipal Tax Sale Enforcements ordered without court oversight breach the Constitution’s Due Process Clauses. These are clearly U.S. Supreme Court issues.

Patrina adds, “I am looking to locate lawyers both skilled in Supreme Court protocol, and keen to restore unencumbered private property within the American system.”

More information and a full reading of the manuscript can be found at: https://hoodwinked.net/brief. To join the movement, please email jp@hoodwinked.net.

ABOUT JOE PATRINA

Constitutional activist and author of Hoodwinked, a U.S. Supreme Court case, Joe looks to sunset the unconstitutional municipal home taxation and property taking irregularities now allowed by state governors. Besides Hoodwinked, Patrina has published books on breast cancer, the origins of the Homo Sapient species, and numerous other historical works. He is also an accomplished singer-songwriter with over 200 titles, and band leader of LittleHouse – a country-rock group in Connecticut. In his early years, Patrina co-founded Wall Street Systems, a global foreign exchange trading platform. For more visit www.JoePatrina.com and www.Hoodwinked.net,