To the Editor,

It has been disheartening to see and hear all the misinformation being spread surrounding the Board of Education’s budget. This misinformation has circulated in emails from Wilton school PTAs, on town social media groups, and by word of mouth. As a former chairman of Wilton’s Board of Finance and longtime town resident, I would like to explain the basic facts and help Wilton residents understand the situation.

The Board of Education’s budget as proposed by the Board of Finance provides a year-over-year INCREASE of 2.2% in total and of more than 3% on a per-student basis. The Board of Finance, acting on the feedback they received from emails, a survey, and conversations with residents, requested only a slight reduction in the increase that the Board of Education asked for – a $485,000 reduction out of a roughly $87 million budget that was proposed by the Board of Education (which gets us to the 2.2% total budget increase). To be clear, the proposed budget is increasing by approximately $2 million.

The Board of Finance has absolutely no authority to influence specific line items in the Board of Education’s budget. It is the Board of Education, with guidance from the superintendent, that decides where to spend and where not to. In its efforts to respond to the Board of Finance’s request to reduce the total budget by $485,000, the Board of Education could easily choose to reduce its budgeted spending on line items such as climate coordinators (roughly $750,000), teachers’ coaches (roughly $1.4 million), or a plethora of others rather than eliminating the proposed hire of a new math specialist. These choices have as a backdrop a 6.4% decline in student enrollment from the 2018-2019 school year to the 2021-2022 school year, with a 15.5% increase in school and district administrative expenses during the same period.

Because meeting special education needs is a federal mandate that our schools must follow, spending tied to students with IEPs will not be reduced, nor has anyone advocated for it to be reduced. Any indication otherwise is inaccurate.

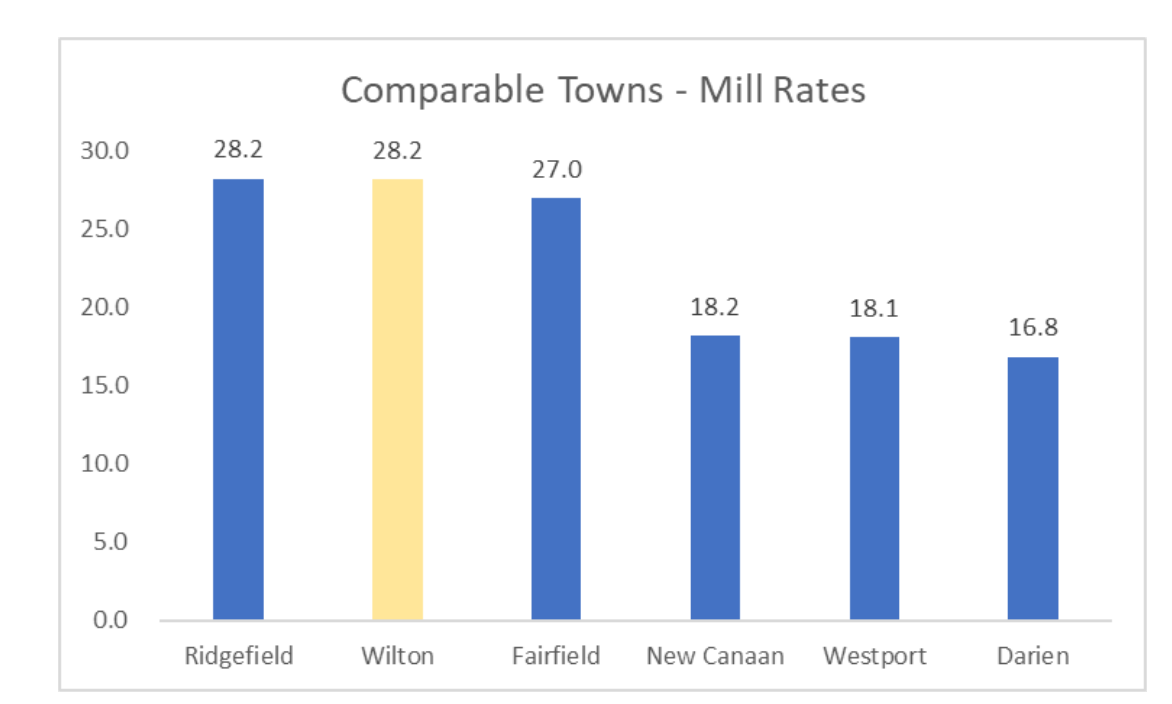

Wilton’s mill (property tax) rate under the new budget is one of the highest rates among comparable towns (see image) - we are already heavily taxed relative to peers in one of the most heavily taxed counties in the country.

I hope that these established facts will help correct some of the misunderstandings and allow Wilton residents to develop informed assessments of current events. Thank you for your interest and involvement in Wilton’s budget process.

Warren Serenbetz

Wilton Board of Finance, 2007-2017

Chairman, Wilton Board of Finance, 2008-2015